What Qualifies For Carbon Credit Exchanges?

admin

- 0

Qualifies For Carbon Credit Exchanges

Carbon credits are the units used to balance greenhouse gas emissions — each credit represents one tonne of carbon dioxide equivalent (CO2e) that has been reduced, sequestered or avoided. They are often purchased by businesses that have committed to reducing their own emissions or by organizations wishing to offset their existing ones. The carbon market is estimated to be worth about $2.4 trillion and is growing rapidly, as more companies announce plans to reduce their emissions and governments set mandates to limit their impact.

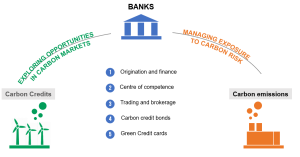

Currently, the majority of carbon credits are created through agricultural and forestry projects. But they can also be produced through other kinds of initiatives that remove greenhouse gases from the atmosphere, like landfills and power plants. Individuals and companies that want to offset their own emissions can then buy these credits from middlemen or directly from those who have captured them. This is what’s known as the voluntary market for carbon credit exchange.

Other credits are created through what’s known as a cap-and-trade program, where regulators set a limit on emissions, then allow businesses to trade permits for the right to emit up to that number each year. This kind of carbon trading is regulated and overseen by regulators, and is most common in the European Union and some US states.

The remaining portion of the carbon market is comprised of a compliance carbon market, where the emission reductions need to be verified and certified by an independent certifying authority. This is a requirement in many countries and regions that have adopted some form of a carbon pricing system, such as the Clean Air Act and the Kyoto Protocol.

What Qualifies For Carbon Credit Exchanges?

For the compliance markets, there are several attributes that a credit must have to qualify as an offset. It must be created through a credible project that is monitored and verified using an approved method, such as the Verified Emission Reduction (VER) or the Climate Action Reserve (CER). The verification process includes a detailed project assessment, an on-site inspection and monitoring of a CER/VER project, an audit report by an accredited third party, and a carbon registry that records the verified emission reductions.

To improve the quality of the voluntary carbon markets, we need standards that ensure that carbon credits represent genuine emissions reductions. One option is to create “reference contracts,” which combine core carbon principles and a standard taxonomy of additional attributes, which would make it easier for buyers to find suppliers that meet their requirements. A resilient and scalable infrastructure would enable these reference contracts to be traded on an exchange, support post-trade activities, provide counterparty default protection and facilitate supply chain financing and data availability.

At Nasdaq, we have the technology to help build an exchange that matches buyers and sellers based on multiple parameters, ensuring that buyers are acquiring credits that meet their requirements. Our scalable platform is built to grow with your marketplace and can be customized to your unique specifications. Contact us to learn more.